Accounting & Taxation Training

Welcome to the Basic and Advanced Computer Skills Course!

Training courses in Accounting & Taxation

Overview of Accounting & Taxation Training Programs

In business, one of the most vital functions is accounting. If you want to run business successfully in this competitive business world of today, you always need to have good control over your business’ finances. It is always beneficial to have a well-trained in-house accounting and finance team and so, make sure that the team members are provided with professional accounting training courses in Parkland College from time to time so as to keep them updated all the time with the latest trends and best practices in the industry.

Explore Training Programs

Fundamentals of Finance, Accounting & Budgeting

Financial management has a key role in any business, irrespective of the size of the company. It is a crucial part of organisational management and cannot be considered as a separate task to be left to finance team. Financial management comprises of planning, organising, controlling and monitoring financial means in order to achieve organisational objectives.

Course Overview

Read Course Overview

This course presents the underlying framework and fundamental of Finance, Accounting & Budgeting in the context of how accounting fits into the overall business environment of contemporary society. Participants will learn how accounting functions as an information development and communication system that supports economic decision making and provides value to entities and society. As well this course provides an overview of the essential tools and the skills to build world-class standards into your budgeting. Important elements of this programme include making your budgeting process more efficient & effective.

Important Features

The important features of the Fundamentals of Finance, Accounting & Budgeting training course are:

Read important features

- Understanding basics of Finance & Accounting

- Generally Accepted Accounting Principles (GAAP)

- Producing financial statements and analysis techniques

- Preparing efficient & effective budget

- Analyzing Financial indicators and using it in planning

Learning Objectives

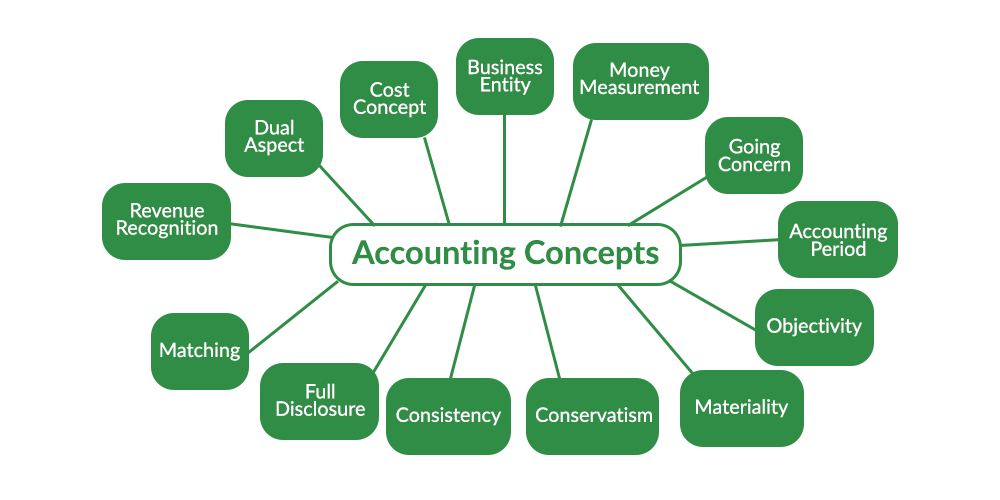

- Explain basic accounting concepts, terminology, principles, processes and procedures that govern how the financial statements are prepared. and the relevance to a business department.

- Identify the basic principles used in safeguarding assets and insuring the accuracy of accounting records

- Understand the difference between accrual and cash basis accounting

- Know the importance of accounting in running businesses.

- Understand the accounting cycle.

- Explain the components of an annual report.

- Understand how financial information, primarily that provided by the financial statements, can be used to analyze business operations and make economic decisions

- Effectively prepare balance sheets and income statements.

- Analyze a set of financial statements to evaluate the business’ financial health.

- Differentiate the financing options available to a business and situations where each might be used.

- Explain how to prepare a budget and effectively manage the budgeting process

- How to implement advanced planning and control techniques into your budgeting process

- Know how to integrate the budgeting process with the development of the company’s long-term strategic vision

- Successfully build an integrated planning, budgeting and reporting process

- Know how to provide a decision support structure that provides timely and useful information to decision makers

- Apply management tools to the budgeting process that contribute to strategic goals

- Develop ways to increase profitability and performance through stream lined planning and reporting

Target Audience

- All professionals with financial responsibility

- Managers seeking to develop their understanding of the accounting methods

- All professionals with planning and budgeting responsibility

- Anyone with direct planning and budgeting responsibility

- Professionals responsible for management reporting

- Corporate governance directors and compliance officials

- Board level members who wish to develop their understanding of Budgeting & Planning

- Professionals who are working with financial organizations

Training Methodology

This highly practical and results-oriented program is based on adult learning concept. This traning will comprise a range of learning activities, including tutor presentations, with question and answer opportunities, demonstration and practice of analytical techniques, group exercises and discussions, using case studies and market information sources. Whilst the theoretical background to financial management will be explained and justified, the main emphasis will be on putting these into a real-world context by providing a practical ‘toolkit’ of financial techniques.

Course Contents

Module 1 - Company objectives & Fundamental of Finance & Accounting

- Measuring company performance

- Introduction to finance: Terminology

- Purpose of financial analysis and reporting

- The finance role in running businesses

- Accounting terminology

- Accounting as an Information System

- The Accounting Equation- what does it mean?

- Generally Accepted Accounting Principles

- Understand the nature, purpose and role of accounting

- The accounting environment

- Walking through an Annual Report

- The Role of External Auditor

- Users of accounting and financial information

- Fundamental Accounting Concepts Cash versus Profit

- Profit and profitability

- Distinguish between accounting and finance

Module 2 - Financial Statements - Understanding and Analysis

- Understanding the Financial Statement

- Why are ratios useful

- Horizontal and trend analysis

- Vertical analysis: common size statements

- Building blocks analysis and reading through the numbers

- Limitations of financial ratio analysis

Module 3 - Management Accounting

- Decision-Making Technique

- Cost behavior: fixed, variable, semi-fixed cost

- Understanding Cost behaviour and types of costs

- Plan for Cost Reduction and Profit Improvement

- Costing Approaches – Full Absorption, Marginal, ABC

- Cost volume profit analysis (CVP)

- Break-even Analysis

- Contribution Margin

- Working Capital Management

- Definition of working capital and working capital management

- Working capital management strategies for current assets

- Balancing profitability and liquidity

- Working capital management strategies for current liabilities

- A trade-off between profitability and certainty

Module 4 - Budgeting and the Strategic Management Framework

- What is the budget?

- The objectives of budgeting

- Types of Budgets

- The budget process

- The Role of Budgeting

- How to identify problems and limitation of budgetary control?

- Approaches to Budget Development

- Using budgets to manage organizational performance

- Finance and budgeting teams- role in supporting strategic planning

- Capital budgeting techniques & Cash Flow

- Using Activity-based Budgeting

- Developing the Cash Budget

- Case study

Module 5 - Advanced Capital Budgeting Evaluation Techniques

- Business risk and cost of capital

- Classifying investment projects

- Analyzing investment and operating cash flows

- The time value of money concept

- The required rate of return

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Multiple internal rates of return

- Modified Internal Rate of Return (MIRR)

- Profitability Index (PI)

- Payback period and discounted payback period

- Capital rationing

- Comparing and evaluating techniques

Prerequisites

None

Materials

You will be provided with a course workbook.

Course Duration (classroom-based)

- 21 Days (8 hours a day)

Payment

- 9900 ETB

Course Level

- Beginner to Advanced level

Training Language

- English (Optional - Amharic)

Internal Auditing & Control Best Practices

Internal Audit & Control has become a vital component for any organisation, it is an independent objective assurance and consulting activity designed to add value and improve an organization’s operations. This applies to both the corporate sector and the public sector. Internal audits provide a number of essential services to company management.

Course Overview

Read Course Overview

‘Internal Audit & Control Best Practices’ is a highly interactive training course, it helps participants to acquire the knowledge to understand the Internal Controls environment and the roles of the respective stakeholders in monitoring, evaluating and the implementation of internal controls best practices. By applying this knowledge, participants will develop the skill to perform an Internal Controls risk assessment to support the organization’s strategic objectives, improve its sustainability and leverage its ability to face future challenges.

Learning Objectives

- Reinforce key elements related to internal audit, its scope and function within the organization

- Understand the relationship between internal stakeholders and types of engagements with them.

- Distinguish the types of internal audit assignments related to operational, compliance or financial internal audit

- Develop engagement process based on considerations, objectives, scope and risk-based internal audit engagements

- Comprehending the organizational governance including principles, various frameworks, codes and legislation.

- Perceive ways to identify, analyze and manage the risks in your business.

- Identification of reportable items, report formulation, and methods of communication.

- Understand the organizational ethics, fraud, and role of internal auditing

- Recognize internal auditing’s role regarding, fraud prevention, detection, and investigation

Target Audience

- Internal auditors who wish to understand their role in the audit process and update the knowledge

- Accountants who wish to understand the scope of the audit and their role

- Financial executives who wish to gain a better understanding of the regulatory audit environment

- Supervisors and managers who are interested in updating, upgrading, and refreshing their knowledge in internal audit.

- Personnel within the public sector who need a better understanding of internal audit role

- Any other professional involved in the preparation for the audit process or the conducting of audit procedures

Course Contents

Module 1 -Introduction to Internal Auditing

- Definition of internal auditing

- Overview of internal auditor’s roles and responsibilities

- Overview of the relationships of the internal auditor

- Board of directors

- Senior management

- Audit committee

- Types of engagements

- Assurance

- Consulting

- Types of audits

- Operational

- Financial

- Compliance

Module 2 - Engagement Process

- Engagement plan (considerations, objectives, scope, risk-based internal audit engagements)

- Engagement resource allocation

- Developing the work program

- Various tools and techniques

- Performing the engagement

- Communicating the results

- Evaluating the audit performed

Module 3 - Organizational Governance and Risk Management

- Organizational governance

- Corporate governance principles

- Various frameworks, codes and legislation

- The role of the audit committee and internal auditing

- Understanding risks and controls

- ERM, methods, processes, and structures

- The relationship between internal audit and risk management

- Various risk assessment processes (models and differences)

- Overall risk management methodologies (risk management framework)

- Control frameworks and procedures

Module 4 - Reporting

- Identifying and communicating reportable items

- Communicating results:

- Criteria (methods, add value, attributes of effective reporting, key summary reporting)

- Quality

- Disclosing noncompliance issues

- Use of the term “conducted in accordance with…”

- Obtaining sufficient evidence to form an opinion

- Follow-up

Module 5 -Ethics and Fraud Overview

- General understanding of organizational ethics

- The role of internal auditing

-

General understanding of internal auditing’s role regarding:

- fraud prevention,

- detection

- investigation

- Case Study

Prerequisites

None

Materials

You will be provided with a course workbook.

Course Duration (classroom-based)

- 15 Days (8 hours a day)

Payment

- 6900 ETB

Course Level

- Beginner to Intermediate level

Training Language

- English (Optional - Amharic)

General Accounting - Level 1

Learning Objectives

- Performing the usual accounting work

- Mastering the current operations

- Knowing how to master the accounting of stock management

Target Audience

- Beginer accountants

- Unique accountants

- Accounting collaborators

Program preview:

- Accounting for current operations

- Balance sheet and income statement

- Optimization of inventory management

- Definition of maintenance stock

- Different methods of inventory management

- The reliability of stocks by statistical analysis

Prerequisites

None

Materials

You will be provided with a course workbook.

Course Duration (classroom-based)

- 3 Days (8 hours a day)

Payment

- 1500 ETB

Course Level

- Beginner level

Training Language

- English (Optional - Amharic)

General Accounting - Level 2

Learning Objectives

- Mastering the organization of the accounting system

- Counting and validating current operations

- Performing the usual accounting controls

Target Audience

- Accountants

- Aid-accountants

Program preview:

- Controlling and accounting for purchase and sales invoices

- Mastering the rules and register VAT

- Process treasury transactions

- Calculation of taxable income and corporation tax

- Accounting for investment transactions

- Preparing year-end operations

- Calculation and recording of inventory transactions

- Reliability of accounts

Prerequisites

None

Materials

You will be provided with a course workbook.

Course Duration (classroom-based)

- 3 Days (8 hours a day)

Payment

- 1500 ETB

Course Level

- Beginner level

Training Language

- English (Optional - Amharic)

General Accounting - Level 3

Learning Objectives

- Evaluating and recording inventories, asset depreciation and amortization

- Counting and validating current operations

- Knowing how to carry out accounting controls

- Building balance sheet and profit and loss account

Target Audience

- Accountants

- Aid-accountants

Program preview:

- Respect the legal obligations

- Completing closing of investment transactions

- Evaluating and accounting for inventory

- Dealing with the closing of the receivables sales cycle

- Evaluating operating expenses and debts and investments and financings

- Knowing how to record a payslip

- Building balance sheet and profit and loss account

- Controlling and count sales invoices

- Checking and accounting for purchase invoices

Prerequisites

None

Materials

You will be provided with a course workbook.

Course Duration (classroom-based)

- 15 Days (8 hours a day)

Payment

- 6900 ETB

Course Level

- Beginner to Intermediate level

Training Language

- English (Optional - Amharic)

Understanding Tax System

Learning Objectives

- Mastering the context and framework of taxation

- Identifying the architecture of the tax system

Target Audience

- Managers

- Accounting officers

- Financial managers

Program preview:

- History of the tax system

- General architecture of the tax system

- Tax Expenditures and Budgetary Grants

- Tax audit

- Informal and tax evasion

Prerequisites

None

Materials

You will be provided with a course workbook.

Course Duration (classroom-based)

- 7 Days (8 hours a day)

Payment

- 3300 ETB

Course Level

- Beginner to Intermediate level

Training Language

- English (Optional - Amharic)

Mastering Company Tax Techniques for Optimizing Tax Burden

Learning Objectives

- Knowing and understanding the main taxes that weigh on the company

- Risk management and corporate strategy

Target Audience

- Accountants

- Tax officials

- Legal officers

Program preview:

- The Moroccan tax system

- VAT: calculation and accounting

- Tax optimization

- Stakeholders

Prerequisites

None

Materials

You will be provided with a course workbook.

Course Duration (classroom-based)

- 7 Days (8 hours a day)

Payment

- 3600 ETB

Course Level

- Advanced level

Training Language

- English (Optional - Amharic)

Frequently Asked Questions

When can I start this course?

- This course is open enrollment, so you can register and start the course whenever you are ready.